TOP VIDEOS

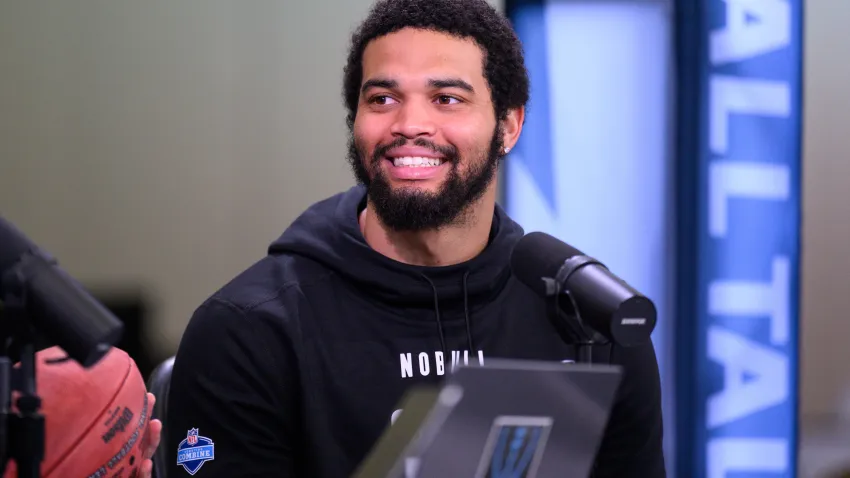

SEE ALL2024 NFL Draft Profile: Who is Byron Murphy

In this 2024 NFL Draft Profile, we take a look at Texas cornerback Byron Murphy

Bears Analysis

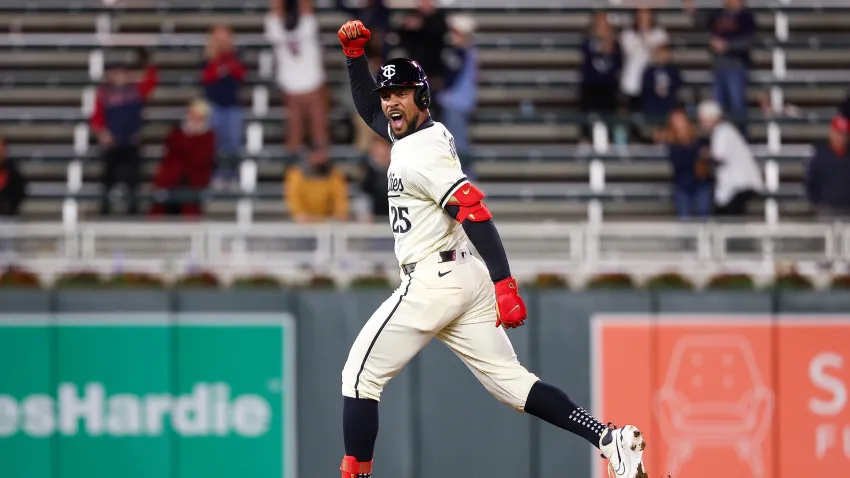

See allCubs News

See allBlackhawks News

See allPODCASTS

-

Blackhawks Talk Podcast

Evaluating rookie seasons from Connor Bedard, Kevin Korchinski and more

Listen Now -

Bulls Talk Podcast

Coby White, DeMar DeRozan NBA award chances, and deep dive into the Bulls' finances

Listen Now -

Cubs Talk Podcast

Cubs battle through injuries to hot start, but how will they respond with tough schedule ahead?

Listen Now -

Under Center: Chicago Bears Podcast

Rome Odunze on Caleb Williams throwing session, potentially being drafted by Bears

Listen Now

PODCASTS

-

White Sox Talk Podcast

Looking for hope in Drew Thorpe and the Birmingham Barons

Listen Now -

NBC Sports' Big Ten Country

Price for Bears to trade up for Marvin Harrison Jr., J.J. McCarthy's potential

Listen Now -

White Sox Talk Podcast

Will this be the worst White Sox season ever?

Listen Now -

NBC Sports' Big Ten Country

WNBA Draft takes center stage, and which Big Ten player will have the best NFL career?

Listen Now